The Evolving Landscape of Personal Auto Insurance Costs

The cost of personal auto insurance in the United States is a topic of constant discussion for many drivers. It’s a dynamic market, continually reshaped by a variety of factors, from economic shifts to driving behaviors, and most notably, the rapid advancements in technology. Understanding How Technology Affects Auto Premiums is crucial for any consumer seeking to navigate their coverage options and budget effectively. While traditional elements have long influenced insurance rates, modern innovations are introducing new complexities and opportunities.

Auto insurance serves as a vital financial safeguard, protecting individuals and families from the significant costs associated with vehicle accidents, theft, and other damages. With nearly all states requiring some form of personal liability auto insurance, its impact on household budgets and the broader economy is undeniable. Recent years have seen notable changes in premium trends, loss severity, and frequency, highlighting the ongoing need for both insurers and policyholders to adapt to the evolving environment. For a foundational understanding of previous insights, you might refer to our earlier analysis, Treasury Report Personal Auto Tech Impact Analysis.

Beyond the Basics Understanding Key Factors Influencing Auto Rates

Before delving into the digital realm, it’s essential to grasp the fundamental factors that influence auto insurance rates. These elements form the bedrock upon which technology builds, further refining risk assessments:

- Driving Record: A clean driving history, free of accidents and violations, remains one of the most significant determinants of lower premiums. Safe drivers are simply less risky to insure.

- Vehicle Type: The make, model, age, and safety features of your car play a substantial role. Expensive luxury vehicles or high-performance cars generally cost more to insure due to higher repair costs and increased theft risk. Vehicles equipped with advanced safety features, however, may qualify for discounts.

- Location: Where you live and primarily park your car impacts your rates. Urban areas with higher traffic density, crime rates, or a greater incidence of severe weather events typically see higher premiums.

- Demographics: Factors like age, gender, and marital status, often referred to as proxy factors, have historically been used in underwriting. However, state regulators are increasingly reviewing their continued use to ensure fairness and prevent potential biases.

- Credit History: In many states, an individual’s credit-based insurance score can influence their premium. A higher score often indicates greater financial responsibility, which insurers associate with a lower likelihood of filing claims.

These traditional factors are now increasingly combined with new data streams and analytical capabilities, providing a more granular and personalized assessment of risk.

The Digital Shift How Technology Affects Auto Premiums

The integration of technology is revolutionizing the auto insurance industry, profoundly changing how premiums are calculated and managed. This digital shift allows for more personalized and dynamic pricing based on actual driving behavior and vehicle characteristics. Understanding How Technology Affects Auto Premiums is key to grasping the future of your coverage costs. Key technological advancements include:

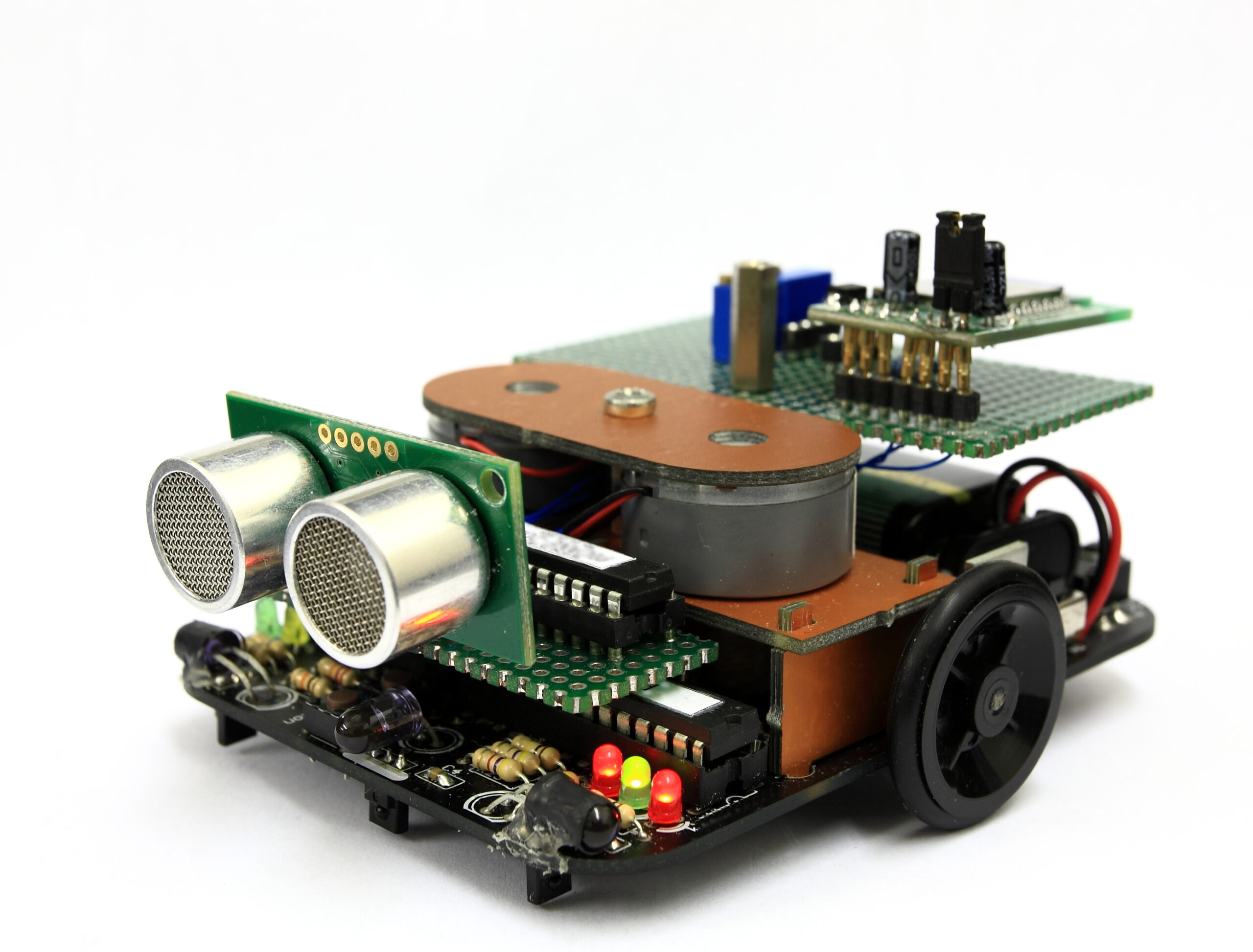

- Telematics and Usage-Based Insurance (UBI): These programs utilize devices installed in vehicles or smartphone apps to track actual driving habits. Data points like speed, braking, acceleration, mileage, and even the time of day driven are collected. This allows insurers to offer premiums directly aligned with an individual’s specific driving risk, often leading to discounts for safer drivers.

- Artificial Intelligence (AI) and Machine Learning (ML): AI algorithms are capable of analyzing vast datasets, including driving behavior, claims history, and external factors, to predict risk with far greater accuracy than traditional methods. This enables more precise premium setting and can significantly streamline the claims process, leading to faster resolution for policyholders. For a comprehensive look at AI’s impact on the future of insurance, an insightful report from McKinsey provides further details.

- Advanced Driver-Assistance Systems (ADAS): Features like automatic emergency braking, lane-keeping assist, and blind-spot monitoring are becoming standard in modern vehicles. While these technologies aim to reduce the frequency and severity of accidents, they also increase vehicle repair costs due to complex sensors and integrated systems. This creates a balancing act for insurers when setting premiums.

- Connected Vehicles and IoT: The Internet of Things (IoT) is making cars increasingly smart, collecting and transmitting data about vehicle health, location, and driving patterns. This real-time data offers new avenues for insurers to assess risk and potentially offer proactive services.

For more detailed information on how these innovations are specifically shaping your rates, consider reading our post on New Tech & Your Rates: Technology Shaping Auto Insurance Premiums.

New Technologies and Emerging Consumer Considerations

While technology offers the promise of more accurate and personalized auto insurance premiums, it also introduces new considerations for consumers. The proliferation of data collection, particularly through telematics and connected vehicles, raises valid concerns about privacy and data security. Consumers want assurances that their driving data is being used responsibly and securely.

The rise of artificial intelligence in underwriting also brings to light the potential for algorithmic bias. Insurers must ensure that AI models are transparent and fair, not inadvertently discriminating against certain groups based on data patterns that may correlate with protected characteristics. As technology continues to advance, so too does the complexity of vehicle repairs, especially for cars equipped with sophisticated ADAS. This can lead to higher repair costs following an accident, which in turn can influence claims severity and, ultimately, premiums.

The advent of self-driving cars also presents a fascinating future for auto insurance. While fully autonomous vehicles are still evolving, their widespread adoption could dramatically reduce human error-related accidents, potentially leading to lower premiums for drivers of such vehicles. You can explore this topic further in The Zebra’s discussion on how self-driving cars will impact car insurance.

Shaping the Future The Role of Regulation and Consumer Awareness

As technology continues to reshape the auto insurance landscape, regulators and policymakers play a critical role in balancing innovation with consumer protection. Their focus areas include:

- Monitoring Costs and Availability: Regulators continuously assess the impact of technological changes on the affordability and accessibility of auto insurance for all consumers.

- Reviewing Proxy Factors: There’s ongoing scrutiny of traditional proxy factors like age, credit history, and marital status to determine their continued appropriateness in a data-rich environment.

- Addressing AI and Data Ethics: Developing clear guidelines for the ethical use of artificial intelligence in underwriting, ensuring transparency, data privacy, and cybersecurity. This also involves working to prevent discriminatory outcomes that might arise from biased data or algorithms.

- Promoting Accident Reduction: Encouraging insurers and drivers to invest in safety measures and technologies that contribute to reducing the frequency and severity of accidents, thereby fostering a safer driving environment and potentially lower overall costs.

The National Association of Insurance Commissioners (NAIC) actively studies these emerging issues, often conducting surveys on the use of AI and machine learning in the insurance sector to inform state-level regulations. For consumers, understanding How AI Affects Auto Insurance Costs is an important step in navigating this evolving market. It empowers you to ask informed questions and make choices that align with your financial goals and driving habits.

Ultimately, the key to navigating this technologically advanced auto insurance market lies in staying informed and being proactive. Regularly reviewing your policy, considering usage-based insurance programs if you’re a safe driver, and comparing quotes from various providers annually can help you find suitable coverage that meets your needs without overpaying. For general information on various auto insurance coverages, you can visit our Auto/Car Insurance page.

Have questions? Contact us here.