Your Essential Guide to Auto Insurance Basics Understanding Your Coverage with Beach Insurance LLC

By Beach Insurance LLC|2025-08-05T13:32:20+00:00August 7, 2025|Categories: Car Insurance, Insurance Tips|Tags: 2025 Auto Insurance, Accident Protection, Accident Risk Mitigation, Age and Gender Factors, Asset Protection, Auto coverage limits, Auto Insurance Policy, Auto Insurance Premiums, Beach Insurance LLC, Bodily Injury Liability, Calculating Deductibles, Clean Driving Record, collision coverage, comprehensive coverage, Credit Score Impact, Declarations Page, family financial security, Financial Hardship Prevention, Liability Coverage, Location Factors, Medical Payments (MedPay), Mileage Driven, Personal Injury Protection (PIP), Property Damage Liability, Rental Reimbursement, Roadside Assistance, Underinsured Motorist Coverage, uninsured motorist coverage, United Policyholders, Vehicle Type|Comments Off on Your Essential Guide to Auto Insurance Basics Understanding Your Coverage with Beach Insurance LLC

Understanding the Importance of Auto InsuranceNavigating the world of automotive [...]

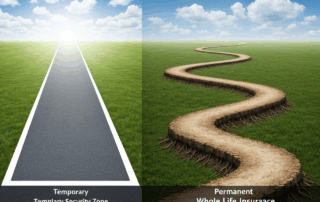

Term Life vs. Whole Life Insurance: Which Coverage Is Best for You?

By Beach Insurance LLC|2025-08-04T12:19:33+00:00August 6, 2025|Categories: Insurance Tips, Life Insurance|Tags: 2025 Life Insurance Trends, Accelerated death benefit, Accident Financial Protection, Auto Insurance Premiums, Beach Insurance LLC, Beneficiaries, cash value insurance, Child Education Funding, estate planning, Family Financial Future, family financial security, Financial Goals, Financial Needs Assessment, fixed premiums, Guaranteed Cash Value, Home Insurance Affordability, Insurance Policy Selection, Investment Strategy, Laddering Insurance, life insurance comparison, Mortgage Protection, Permanent Life Coverage, Personalized Insurance Guidance, Policy Loans, Policy Withdrawals, Retirement Income Planning, Tax-Deferred Growth, Temporary Life Coverage, term life insurance, whole life insurance|Comments Off on Term Life vs. Whole Life Insurance: Which Coverage Is Best for You?

Understanding Life Insurance: Protecting Your Loved Ones' FutureNavigating the world [...]

Secure Your Dream Home: Your First Time Home Buyers Insurance Guide 2025 by Beach Insurance LLC

By Beach Insurance LLC|2025-08-04T12:18:45+00:00August 5, 2025|Categories: Flood Insurance, Home Insurance, Home Owners Insurance, Insurance Tips, Umbrella Insurance|Tags: Accident Risk Mitigation, Actual Cash Value, Additional Living Expenses (ALE), Beach Insurance LLC, Bundling Home and Auto Insurance, Charleston flood insurance, claims history, Credit-Based Insurance Score, Deductible Amount, Dwelling Coverage, earthquake insurance, Financial Safety Net, First Time Home Buyers, Florida Homeowners Insurance, HO-3 Policy, Home Inventory, Home security systems, Homeownership Protection, Insurance Policy Add-ons, Insurance Premium Discounts, Insurance Quote Comparison, loss of use coverage, Mortgage Lender Requirements, National Flood Insurance Program (NFIP), New Homeowner Checklist, Personal Liability Coverage, Personal Property Coverage, Replacement Cost Coverage, Scheduled Personal Property, Umbrella Insurance|Comments Off on Secure Your Dream Home: Your First Time Home Buyers Insurance Guide 2025 by Beach Insurance LLC

The Excitement of Homeownership: Why Insurance Is KeyBuying your first [...]

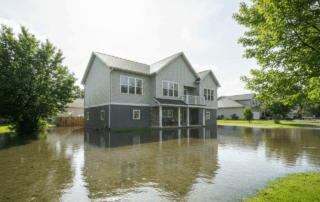

Protecting Your Investment: Flood Insurance What Homeowners Should Know for Peace of Mind

By Beach Insurance LLC|2025-08-03T23:46:19+00:00August 4, 2025|Categories: Flood Insurance, Home Insurance, Home Owners Insurance, Insurance Tips|Tags: 30-Day Waiting Period, Accident Financial Protection, Accident Risk Mitigation, Actual Cash Value (ACV), Additional Living Expenses (ALE), Auto Insurance Claims, Beach Insurance LLC, Charleston flood insurance, Comprehensive Home Protection, Contents Coverage, Dwelling Coverage, FEMA, FEMA flood maps, flood damage, Flood Definition, flood risk assessment, Florida Homeowners Insurance, High-Risk Flood Zones, Mortgage Lender Requirements, Mudslides, National Flood Insurance Program (NFIP), Natural Disaster Preparedness, Personal Property Protection, Policy Comparisons, Policy Exclusions, private flood insurance, Proactive Insurance Planning, Replacement Cost Value (RCV), Storm Surges, water damage|Comments Off on Protecting Your Investment: Flood Insurance What Homeowners Should Know for Peace of Mind

For many homeowners, the thought of flood damage might seem [...]

Unlock Savings: Essential Factors That Impact Your Cost of Homeowners Insurance with Beach Insurance LLC

By Beach Insurance LLC|2025-08-01T12:04:24+00:00August 3, 2025|Categories: Home Insurance, Home Owners Insurance, Insurance Tips|Tags: Annual Policy Review, Auto coverage limits, Auto Insurance Premium Factors, Beach Insurance LLC, Bundling Insurance, Claims History Impact, Cold Weather Claims Prevention, Cost to Rebuild Home, Credit-Based Insurance Score, Dwelling Coverage, flood risk assessment, Geographic Location Risk, Home Construction Materials, Home Insurance Deductibles, Home Maintenance Benefits, Home security systems, Home-Based Business Insurance, Homeowners Insurance Costs, Insurance Savings Tips, Liability Coverage, Mortgage Insurance PMI, Multi-policy Discounts, Natural Disaster Risk, Personal Property Coverage, Policy customization, Property Age Influence, Property Liability Risk, Protecting Home Investment, Smart Home Device Discounts, Smoke Detectors|Comments Off on Unlock Savings: Essential Factors That Impact Your Cost of Homeowners Insurance with Beach Insurance LLC

Understanding Your Homeowners Insurance Costs with Beach Insurance LLCNavigating the [...]

Secure Your Loved Ones’ Future: What is a Life Insurance Beneficiary? A Guide from Beach Insurance LLC

By Beach Insurance LLC|2025-07-31T16:11:49+00:00August 2, 2025|Categories: Insurance|Tags: Accelerated death benefit, Annual Policy Review, Asset Distribution, Beach Insurance LLC, Beneficiary Designation, Birth of Children (Beneficiary Update), Business Succession Planning, Contingency Planning, Contingent Beneficiary, Creditor Claims, Death of Beneficiary, Divorce (Beneficiary Update), estate planning, Estate Planning Attorney, family financial security, Financial Advisor, Financial Planning, Irrevocable Beneficiary, Legal Complexities, Life Insurance Beneficiaries, Marriage (Beneficiary Update), Minor Beneficiaries, Policyholder Responsibilities, Primary Beneficiary, Probate Process, Protecting Legacy, Trusts for Minors, Unclaimed Benefits, Updating Beneficiaries|Comments Off on Secure Your Loved Ones’ Future: What is a Life Insurance Beneficiary? A Guide from Beach Insurance LLC

Protecting Your Legacy: An Introduction to Life Insurance BeneficiariesLife insurance [...]