The Western North Carolina (NC) mountains, though geographically distinct from coastal regions, face increasing flood risks due to heavy rainfall, flash floods, and riverine flooding. Unlike coastal areas where storm surge is a primary threat, the steep terrain in the mountains intensifies the impact of intense precipitation, leading to rapid water level increases and significant property damage.

Despite this risk, flood insurance adoption remains low. Data from the Federal Emergency Management Agency (FEMA) indicates that in Buncombe, Haywood, and Transylvania counties, only about one percent of structures are covered by flood insurance through the National Flood Insurance Program (NFIP). This suggests an underestimation of risk or a lack of awareness of available insurance options among residents.

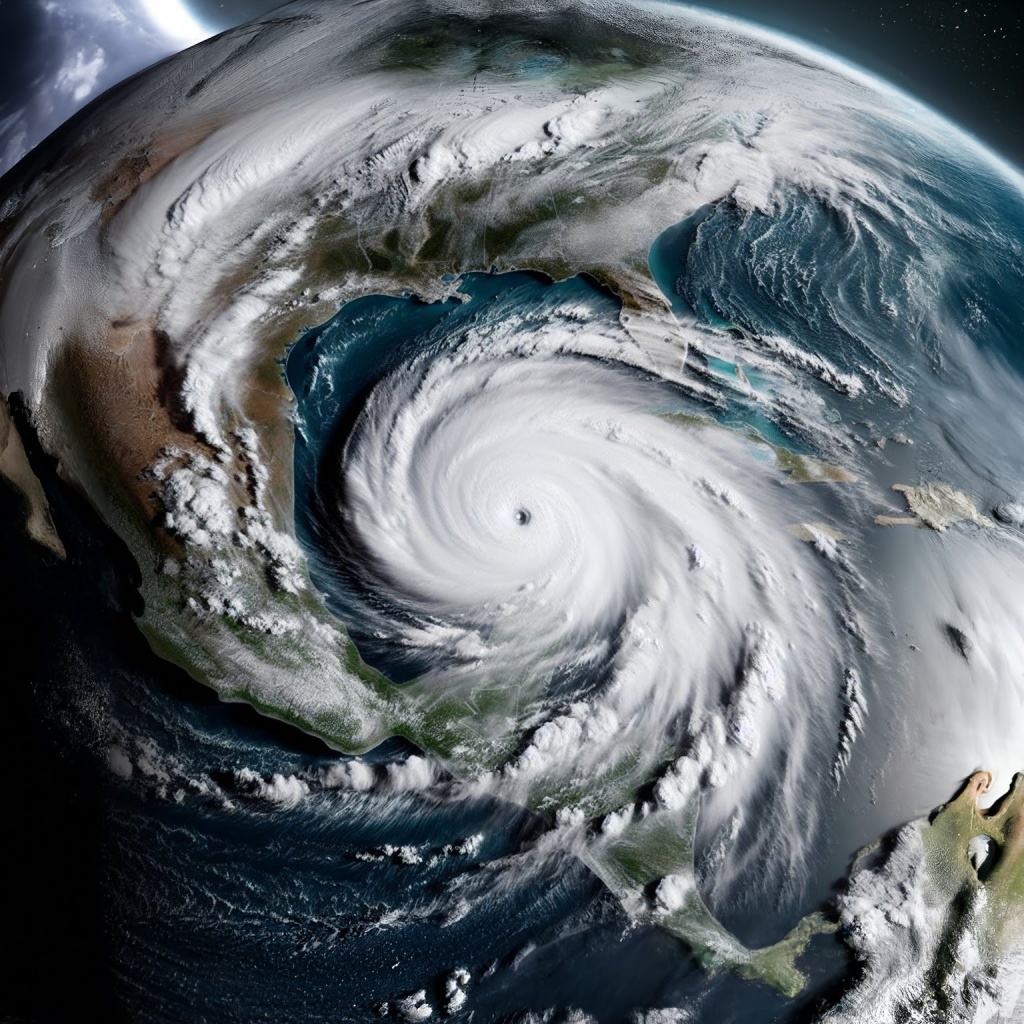

The devastation caused by Hurricane Helene was a stark reminder of the region’s vulnerability to flooding and related hazards. Many residents faced insurance claim denials, particularly for landslide damage, as standard homeowners’ policies typically do not cover floods or earth movements. This guide provides an in-depth analysis of the current flood insurance landscape in Western NC, explaining how residents can secure coverage and avoid coverage gaps. Beach Insurance LLC can help homeowners and renters navigate their insurance options.

2. Understanding Flood Risk in the Western NC Mountains:

While the Western NC mountains may not face the direct impact of coastal storm surges, the region is susceptible to a variety of flood-related perils. The steep terrain and narrow valleys can exacerbate the effects of heavy rainfall, leading to rapid flash floods that can overwhelm drainage systems and cause significant damage with little warning . Riverine flooding, where rivers and streams overflow their banks due to prolonged rainfall, also poses a substantial threat to properties located near waterways. Moreover, the combination of intense rainfall and unstable mountain slopes increases the risk of mudslides and landslides, which can cause catastrophic damage to homes and infrastructure . As FEMA highlights, flooding is not confined to designated high-risk zones; it can occur anywhere, often unexpectedly, and even a single inch of floodwater can result in up to $25,000 in damages . The events following Hurricane Helene, where several counties experienced what were classified as 1,000-year flood events, underscore the potential for extreme and unpredictable flooding in this region . The term “floodplain,” often used in the context of flood insurance, might not fully capture the diverse flood risks present in mountainous areas. Flooding can occur outside traditionally mapped zones due to unique geographical features and localized, intense rainfall patterns that are characteristic of the region . Furthermore, the increasing frequency and intensity of extreme weather events, potentially linked to climate change, could further elevate the flood risks in the Western NC mountains. Historical data, upon which many flood risk assessments and maps are based, might not accurately reflect the evolving risks in an era of changing climate patterns, where warmer temperatures can contribute to more intense and unpredictable rainfall events, thereby increasing the likelihood of both flash floods and landslides . A critical aspect of understanding flood risk in this region is recognizing the common misconception that standard homeowners insurance policies provide coverage for flood damage. In reality, homeowners insurance typically covers perils such as wind, fire, and theft, but explicitly excludes damage caused by flooding . This lack of awareness contributes significantly to the low flood insurance adoption rates and leaves many homeowners financially vulnerable when floodwaters do rise. The focus on wind damage coverage under standard homeowners policies during hurricanes might inadvertently lead residents to mistakenly believe they are protected against all storm-related damages, overlooking the separate and distinct need for flood insurance.

3. Current Availability of Flood Insurance in Western NC:

3.1 The National Flood Insurance Program (NFIP):

The primary source of flood insurance in the United States is the National Flood Insurance Program (NFIP), which is managed by FEMA . The NFIP makes flood insurance available to homeowners, renters, and business owners in communities that adopt and enforce floodplain management regulations . As of October 2021, 634 communities across North Carolina participated in the NFIP . The NFIP offers coverage up to a maximum of $250,000 for building damage and $100,000 for personal contents for single-to-four family residential structures . For policies purchased through the NFIP, there is generally a 30-day waiting period before the coverage becomes effective, although certain exceptions may apply, such as when the insurance is required by a federally backed lender or is purchased in connection with a community flood map change . Despite the availability of this federal program, the percentage of structures in Buncombe, Haywood, and Transylvania counties with NFIP flood insurance policies is notably low, around one percent . This statistic highlights a significant uninsured flood risk within these Western NC counties, potentially exposing a large number of residents to substantial financial losses in the event of a flood. The combination of a perceived low risk of flooding in mountainous regions and the fact that flood insurance is not mandatory for properties outside designated high-risk flood zones likely contributes to this low adoption rate. It is crucial for residents of the Western NC mountains to understand that flood insurance through the NFIP is available even if their property is not located within a designated high-risk flood plain . The misconception that only those in mapped flood zones need flood insurance can lead to a false sense of security and leave many vulnerable to unexpected flooding events.

3.2 Private Flood Insurance Providers:

In addition to the NFIP, private flood insurance options are also available to residents of Western NC . These private policies may offer certain advantages, such as potentially more competitive pricing in some situations or the availability of higher coverage limits compared to the NFIP’s caps . For homeowners with higher-value properties or those seeking more comprehensive protection, private flood insurance can be a valuable alternative or supplement to NFIP coverage. Several private carriers operate in North Carolina, including those that may specifically serve the Western NC region. Examples of private flood insurance providers mentioned in the research material include Rocket Flood, which emphasizes leveraging technology to offer competitive rates and higher coverage limits ; Allied Trust, Allstate, American Bankers Insurance Company of Florida (Assurant), and many others listed on FloodSmart.gov ; SFI Group, which specializes in providing private flood insurance in Coastal Barrier Resource Areas and non-participating communities ; and Wayah Insurance, an independent agency serving Western NC and Northeast Georgia . Agencies like North Carolina Flood Insurance also work with multiple private carriers to offer a range of options . The availability of these private options provides residents with a broader spectrum of choices to tailor their flood insurance coverage to their specific needs and risk profiles.

4. Navigating Flood Insurance Coverage:

4.1 Determining Flood Risk:

The first step in navigating flood insurance coverage is for residents to understand the specific flood risks associated with their property. FEMA provides flood maps that delineate areas with varying levels of flood risk. These maps are available online through FEMA’s website and often through local government resources . Residents can check these maps to gain an understanding of their property’s location relative to designated flood zones . The North Carolina Flood Mapping Program also offers resources and maps detailing flood insurance studies throughout the state . Additionally, online tools like Flood Factor can provide a more granular assessment of an individual property’s flood risk . While these resources are valuable, it is important for residents in mountainous regions to be aware of their limitations. FEMA flood maps are often based on historical flooding data and may not fully capture the risks associated with localized, intense rainfall and the unique terrain of the Western NC mountains . Therefore, even if a property is not located within a designated high-risk flood zone, residents should not assume they are entirely safe from flooding . The potential for flash floods and riverine flooding in unexpected areas underscores the importance of considering flood insurance regardless of official flood zone designations.

4.2 Assessing Insurance Needs:

Once a resident has a general understanding of their flood risk, the next step is to assess their individual insurance needs. Homeowners should consider the potential financial impact of flood damage, recognizing that even a few inches of water can cause substantial destruction and incur significant repair costs . It is advisable to consider obtaining coverage for both the physical structure of the home and the personal contents within it . Building coverage typically includes the foundation, electrical and plumbing systems, appliances, and permanently installed fixtures, while contents coverage protects personal belongings such as furniture, clothing, and electronics . For renters in the Western NC mountains, obtaining contents-only flood insurance is a way to protect their personal belongings from potential flood damage, even if they do not own the building itself .

4.3 Applying for Flood Insurance:

Applying for flood insurance in Western NC can be done through several avenues. NFIP policies are typically purchased through licensed insurance agents or companies that participate in the program . Residents can contact their existing homeowners insurance provider or seek out an agent who specializes in flood insurance. For those interested in exploring private flood insurance options, they can contact private insurance companies directly or work with independent insurance agents who can provide quotes from multiple carriers . When applying for flood insurance, it is helpful to have relevant property information readily available, such as the property address, year of construction, and details about the foundation type. If an elevation certificate is available, particularly for properties in higher-risk areas, it can be beneficial in determining the appropriate premium . It is crucial to remember the general 30-day waiting period associated with NFIP policies before the coverage takes effect, so it is advisable to apply for coverage well in advance of any anticipated weather events.

5. Key Agencies Offering Flood Insurance:

5.1 The National Flood Insurance Program (NFIP) / FEMA:

The primary agency offering flood insurance nationwide is the National Flood Insurance Program (NFIP), managed by the Federal Emergency Management Agency (FEMA) . Residents of Western NC can obtain information about the NFIP and find participating insurance agents by contacting the NFIP directly at 1-800-427-4661 or by visiting the official website, FloodSmart.gov . While FEMA administers the NFIP, the policies themselves are sold and serviced through a network of over 50 private insurance companies that participate in the NFIP’s Write-Your-Own (WYO) program, as well as through NFIP Direct.

Leave A Comment