The world of auto insurance is constantly evolving, driven by various factors, with technology playing an increasingly pivotal role. Understanding how technology shaping auto insurance premiums is crucial for every driver looking to navigate the complexities of their coverage costs. From the foundation of how rates are set to the cutting-edge innovations that are changing the game, this article will explore the dynamic landscape of personal auto insurance in the U.S. and provide insights into what impacts your wallet.

The Foundation of Auto Insurance Understanding Your Coverage Costs

Auto insurance serves as a financial safety net, protecting drivers from the significant costs associated with accidents, theft, and other damages to their vehicles. In the United States, nearly all states mandate some form of personal liability auto insurance, recognizing its importance for both individual drivers and the broader economy. Auto insurance premiums represented a substantial portion of the U.S. property and casualty insurance market, highlighting its economic significance.

Understanding your coverage costs begins with knowing the types of coverage available. These typically include:

- Liability Coverage: Protects you if you’re at fault in an accident, covering bodily injury and property damage to others.

- Collision Coverage: Pays for damage to your own vehicle resulting from a collision with another car or object.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage.

- Personal Injury Protection (PIP) or MedPay: Covers medical expenses for you and your passengers, regardless of fault.

Each component contributes to your overall premium, and the specific mix you choose, along with state minimum requirements, significantly influences your expenditure.

Unpacking Rising Auto Insurance Costs and Market Dynamics

Recent years have seen a notable increase in auto insurance premiums across the U.S. Several market dynamics contribute to this trend. Factors such as a rise in claims severity (the cost per claim) and shifts in claims frequency impact insurers’ profitability. For instance, the increasing complexity and cost of vehicle repairs, due to advanced technology embedded in modern cars, drive up the expense of collision and comprehensive claims. Additionally, factors like inflation, supply chain issues affecting parts availability, and increased litigation costs can put upward pressure on rates.

These rising costs often translate into a significant budgetary concern for many consumers, leading to an observed increase in uninsured motorists. This creates a challenging cycle for both insurers and policyholders, emphasizing the need for greater transparency and strategies to mitigate expenses.

How Traditional Factors Influence Auto Insurance Rates

While technology is increasingly influencing premiums, traditional underwriting factors still play a significant role in determining your auto insurance rates. Insurers assess risk based on a combination of personal and vehicle-specific data:

- Driving Record: Your history of accidents, traffic violations, and claims is a primary determinant. A clean record often translates to lower premiums.

- Vehicle Type: The make, model, year, safety features, and even the cost of repairs for your specific vehicle impact your rate. More expensive cars or those with high theft rates typically cost more to insure.

- Location: Where you live and primarily drive affects your premium. Urban areas with higher traffic density, crime rates, or accident statistics generally have higher rates than rural areas.

- Annual Mileage: The more you drive, the higher your perceived risk of an accident, which can lead to increased costs.

- Age and Driving Experience: Younger, less experienced drivers typically face higher premiums due to a statistically higher risk of accidents.

- Credit History: In many states, an individual’s credit-based insurance score is used as a proxy factor to predict the likelihood of future claims. A good credit score can often lead to lower rates.

- Demographic Factors: While increasingly scrutinized by regulators, factors like gender and marital status have historically been used by some insurers in their underwriting models.

These traditional factors create a baseline for your premium, which is then further refined by the more advanced data insights provided by emerging technologies.

Advanced Technology Shaping Auto Insurance Premiums

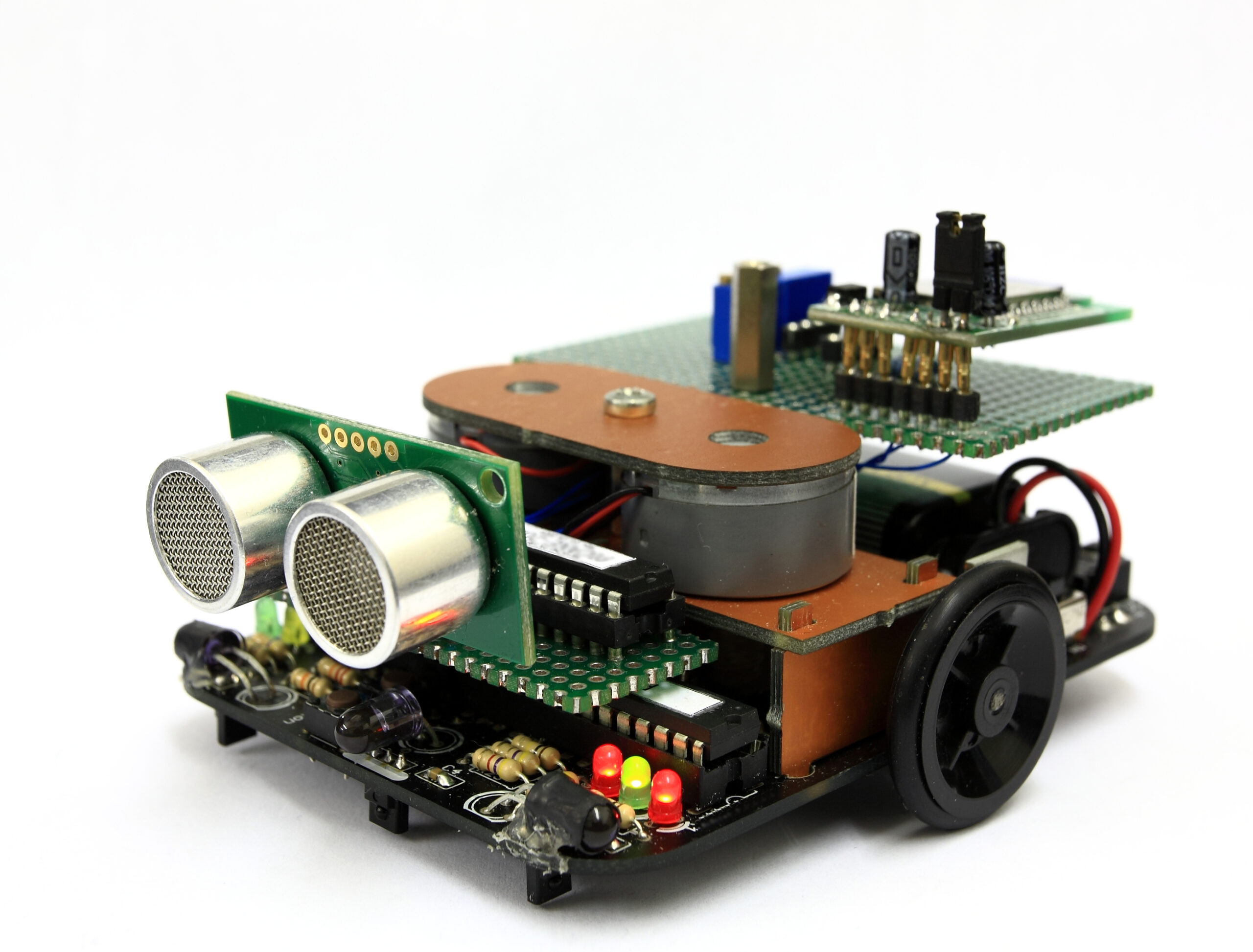

The integration of advanced technology is profoundly changing how auto insurance premiums are calculated and managed. This shift is allowing for more personalized and dynamic pricing based on actual driving behavior and vehicle characteristics. Key technological advancements include:

- Telematics and Usage-Based Insurance (UBI): Devices or smartphone apps track driving habits such as speed, braking, acceleration, mileage, and time of day driven. This data allows insurers to offer premiums directly aligned with an individual’s driving risk. Safer drivers can often qualify for significant discounts.

- Artificial Intelligence (AI) and Machine Learning (ML): AI algorithms analyze vast datasets, including driving behavior, claims history, and external factors, to predict risk with greater accuracy. This enables more precise premium setting and can streamline the claims process. For more on AI’s impact, see this insightful report from McKinsey.

- Advanced Driver-Assistance Systems (ADAS): Features like automatic emergency braking, lane-keeping assist, and blind-spot monitoring reduce the likelihood and severity of accidents. While these technologies aim to make roads safer, they can also increase repair costs, as the sophisticated sensors and components are expensive to replace or recalibrate after a collision.

- Connected Cars and Data Sharing: Modern vehicles are increasingly equipped with connectivity features that can transmit data on vehicle performance and driver behavior directly to manufacturers and, potentially, to insurers with driver consent. This granular data offers a more comprehensive view of risk.

These technological innovations are moving the industry toward a future where premiums are less about broad demographic averages and more about individual risk profiles.

Consumer Concerns Navigating Privacy and Data Security

While the benefits of technology in insurance are evident, the increased use of data raises important consumer concerns, particularly regarding privacy and data security. As telematics devices and connected car features collect more personal driving data, questions arise about:

- Data Collection and Usage: What specific data points are being collected, how are they being used, and for how long are they stored?

- Security Breaches: The risk of cyberattacks and data breaches increases with the volume of sensitive information being collected and transmitted.

- Transparency: Consumers want clear understanding of how their data influences their premiums and what control they have over their information.

- Fairness and Bias: Concerns exist that certain proxy factors or data interpretations by AI could inadvertently lead to discriminatory practices.

It’s vital for consumers to understand the terms of any usage-based insurance program or data-sharing agreement and to choose insurers with strong data protection policies. For a deeper dive into the evolving technological landscape, consider this research report on evolving technology in auto insurance by the Society of Actuaries.

Regulatory Actions and the Path Forward for Auto Insurance

State insurance regulators and policymakers are actively monitoring and evaluating the public policy implications of technological advancements in auto insurance. Their focus areas include:

- Monitoring Costs and Availability: Ensuring that auto insurance remains affordable and accessible for all consumers, despite market changes.

- Reviewing Proxy Factors: Many states are reassessing the continued use of factors like age, credit history, and gender in premium calculations to ensure fairness and reduce potential for bias.

- Addressing AI and Data Ethics: Regulators are developing frameworks to govern the ethical use of artificial intelligence in underwriting, focusing on transparency, data privacy, and cybersecurity.

- Promoting Accident Reduction: Encouraging insurers and drivers to invest in safety measures and technologies that reduce the frequency and severity of accidents, thereby lowering overall costs.

The National Association of Insurance Commissioners (NAIC) plays a key role in studying these issues and providing recommendations for state-level regulation, often conducting surveys on AI and machine learning usage. As the industry moves forward, collaboration between insurers, regulators, and consumers will be essential to harness the benefits of technology while safeguarding consumer interests. To learn more about optimizing your auto coverage, visit our Auto/Car Insurance page or read our article on Essential Tips: How to Lower 2025 Auto Insurance.

Have questions? Contact us here.