Introducing the Treasury Report on Auto Insurance and Technology

The landscape of personal auto insurance is constantly evolving, driven by economic factors, regulatory considerations, and significant technological advancements. To better understand these dynamics and their effects on American consumers, the U.S. Department of the Treasury’s Federal Insurance Office (FIO) recently released an important document: the Report on Personal Auto Insurance Markets and Technological Change. This report offers a comprehensive look at the current state of the market, delves into rising costs, examines traditional underwriting practices, and, critically, analyzes the Treasury report personal auto tech impact.

This comprehensive report serves as a valuable resource for policymakers, industry professionals, and consumers alike. It aims to shed light on the complex factors influencing auto insurance affordability and availability across the United States. For most Americans, auto insurance is not just a financial product; it’s a necessity required by law in nearly every state to operate a vehicle. Understanding the forces shaping this market, as outlined in the Treasury’s findings, is essential for making informed decisions about coverage and costs. The report underscores the significant role personal auto insurance plays in the financial stability of households and the broader national economy.

The FIO’s mandate includes monitoring the insurance sector, and this report is a direct result of that ongoing effort. By focusing specifically on the personal auto segment, which represents a substantial portion of the property and casualty market, the Treasury provides a detailed analysis of trends that directly affect the wallets of millions of drivers. The report doesn’t just present data; it also explores the underlying reasons behind the changes observed and looks forward to the future role of technology.

Key Findings on Personal Auto Insurance Market Costs

One of the primary areas of focus for the Treasury report was the cost dynamics within the personal auto insurance market between 2015 and 2022. The findings indicated a clear trend: premiums for the minimum required liability coverage saw an increase during this period when viewed in nominal terms. This rise in cost is a significant concern for consumers nationwide. Minimum liability coverage is the foundational level of protection required by law in almost every state, making its increasing cost particularly impactful for budget-conscious drivers.

Alongside the rise in premiums, the report also noted an increase in loss severity. Loss severity refers to the average cost of a claim when an accident or incident occurs. This means that while the frequency of claims might have decreased (as also observed in the report), the cost to repair vehicles or cover medical expenses for each incident has gone up. Several factors likely contribute to increased loss severity. Modern vehicles are equipped with complex technology, sensors, and advanced materials that are expensive to repair or replace after a collision. Medical costs also continue to rise, impacting the bodily injury liability and Personal Injury Protection (PIP) or Medical Payments (MedPay) components of auto insurance claims.

Conversely, the report found a decrease in loss frequency, meaning fewer accidents or insured incidents occurred on average. This could be attributed to various factors, potentially including improved vehicle safety features, increased driver awareness campaigns, or even changes in driving behavior influenced by economic conditions or external events. However, the decrease in frequency was seemingly outweighed by the increase in severity and other costs borne by insurers.

The combination of rising premiums, increasing loss severity, and, despite lower frequency, overall higher claims costs led to a challenging environment for auto insurers. The report highlighted that personal auto insurers generally experienced underwriting losses during the 2015-2022 timeframe. Underwriting loss occurs when the money an insurance company pays out in claims and expenses is more than the money it collects from premiums. This situation can put pressure on insurers to seek rate increases to remain profitable and maintain their ability to pay future claims.

The rising cost of auto insurance premiums has a direct consequence for consumers. For many households, especially those with lower or moderate incomes, auto insurance represents a considerable portion of their monthly budget. When premiums increase, it can strain these budgets, potentially leading some drivers to reduce their coverage levels or, in some cases, forgo insurance altogether. The Treasury report observed that the rising cost of premiums likely contributed to an increase in the number of uninsured motorists. This is a concerning trend because uninsured drivers pose a financial risk to everyone else on the road. If you are involved in an accident with an uninsured driver, your own uninsured/underinsured motorist coverage would need to cover the damages, potentially leading to higher costs for insured drivers overall.

Understanding these cost dynamics is crucial for consumers. Factors such as where you live (garaging address), your driving history, the type of vehicle you own, and even the coverages you choose all impact your individual premium. While the report addresses market-wide trends, individual experiences can vary. Reviewing your policy and understanding what influences your specific rate is always a good idea. Factors impacting car insurance rates are numerous and constantly shifting.

Examining the Use of Proxy Factors in Auto Insurance Pricing

The process by which auto insurance companies determine how much to charge individual policyholders is known as underwriting and ratemaking. Insurers use various data points to assess the risk associated with insuring a particular driver and vehicle. While factors directly related to driving risk, such as driving history, accident records, and traffic violations, are widely accepted, insurers also often utilize what the report refers to as proxy factors.

Proxy factors are characteristics of an individual that insurers have historically used because statistical analysis suggested a correlation, though not necessarily a direct causal link, with the likelihood of filing a claim or the potential cost of that claim. Common examples of these proxy factors, as mentioned in the Treasury report, include:

- Age

- Credit history or credit score

- Education level

- Gender

- Marital status

The use of these factors in setting insurance premiums has become a subject of increasing debate and scrutiny among state regulators and policymakers. Critics argue that while these factors may statistically correlate with risk on a broad population level, they may not accurately reflect the individual driving behavior or risk profile of a specific policyholder. Furthermore, there are significant concerns that the use of some proxy factors, particularly credit history, age, gender, and education level, can disproportionately impact certain socioeconomic groups or protected classes, potentially leading to unfair or discriminatory pricing practices.

For example, studies have shown that using credit history in insurance pricing can result in higher premiums for individuals with lower credit scores, who may already face financial challenges. Similarly, using age or gender as rating factors has been challenged on the grounds that they are broad generalizations that don’t account for individual driving competence or safety habits. The report notes that state regulators and other policymakers are actively reviewing the continued use of these proxy factors by insurers. This review is driven by a desire to ensure that auto insurance pricing is fair, transparent, and based on factors that are truly indicative of driving risk rather than socioeconomic status or demographic characteristics.

The debate surrounding proxy factors is complex. Insurers maintain that these factors are actuarially sound and necessary to accurately price risk, preventing lower-risk drivers from subsidizing higher-risk drivers. They argue that access to comprehensive data, including these factors, allows for more precise pricing, which ultimately benefits consumers by offering rates that more closely match their predicted risk level. However, consumer advocates and some policymakers argue that fairness and equity should be paramount and that rating factors should be limited to those directly related to driving behavior and vehicle usage.

As this discussion continues, consumers may see changes in how their auto insurance rates are calculated in the future, depending on regulatory actions in their state. It highlights the importance of understanding not just the price of your policy but also the factors that went into determining that price. Being an informed consumer means understanding your policy details, including how rating factors influence your premium.

Understanding the Treasury Report Personal Auto Tech Impact

Beyond costs and traditional rating methods, a significant portion of the Treasury report is dedicated to exploring how technology is fundamentally reshaping the personal auto insurance industry. This focus on the Treasury report personal auto tech impact highlights the rapid pace of innovation and its potential consequences for both insurers and consumers. Technology is not just changing how policies are sold or managed; it’s impacting how risk is assessed, how claims are processed, and even how premiums are determined.

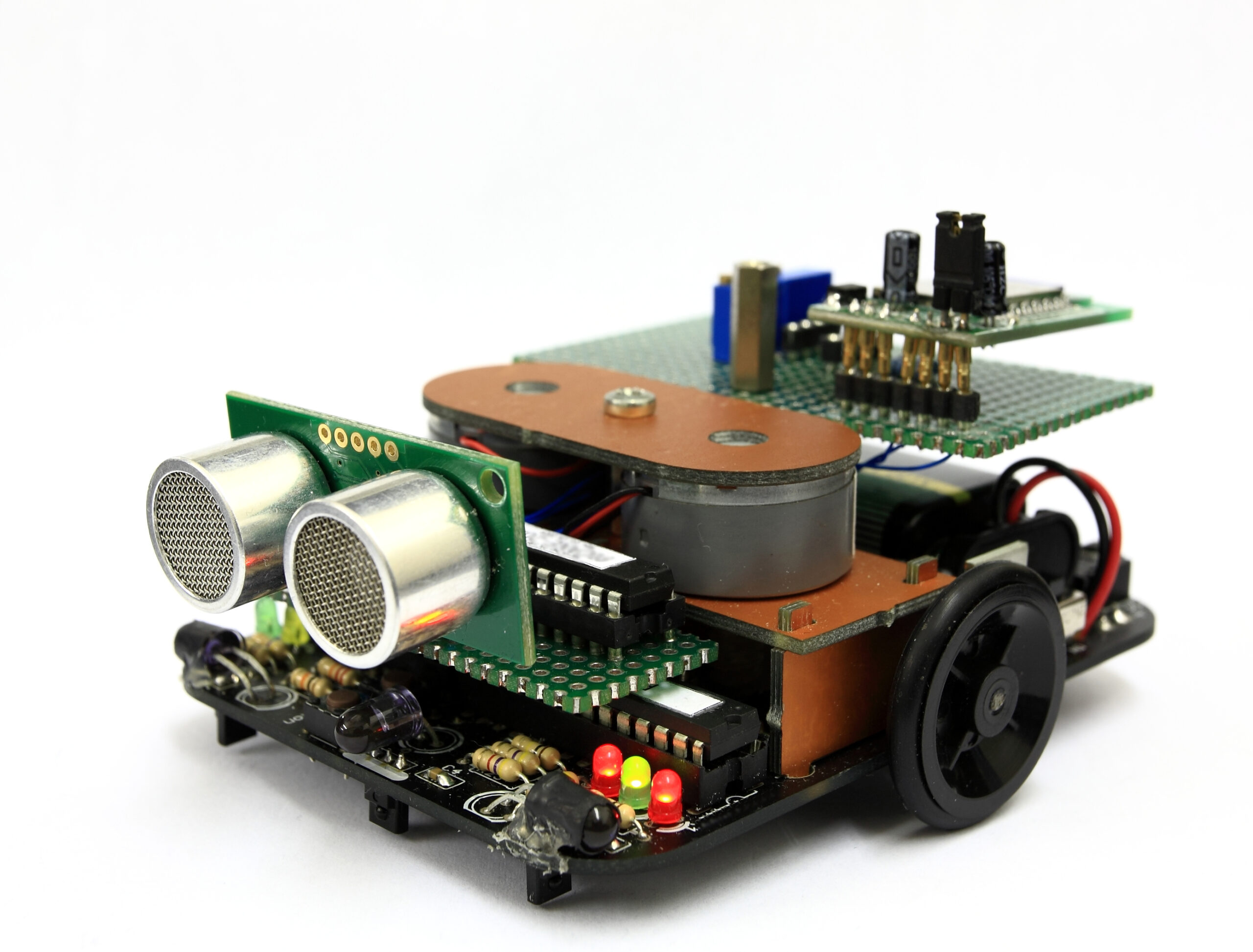

One of the most prominent technological shifts discussed is the increasing sophistication of data collection and analysis. Modern vehicles often come equipped with telematics devices or have capabilities that can track driving habits, such as speed, braking patterns, mileage, and time of day driven. This usage-based insurance model, empowered by technology, allows insurers to potentially align premiums more closely with actual driving behavior rather than relying solely on historical data and demographic factors. For careful drivers, this could lead to lower premiums. Our blog post on telematics can help you save on auto insurance provides more details on this specific technology.

The report indicates that these technologies, while offering the promise of more personalized and potentially fairer pricing based on individual actions, also introduce new complexities and concerns. Consumer apprehension about security, privacy, and transparency regarding the collection and use of their driving data is a major consideration. When insurers collect vast amounts of personal data, ensuring its security and preventing breaches becomes paramount. Consumers also need to understand exactly what data is being collected, how it is being used to calculate their premium, and who has access to it. The lack of transparency in these areas can erode consumer trust.

Furthermore, the report touches upon the broader implications of technology, including the rise of connected cars and the eventual integration of autonomous vehicle technology. As vehicles become more automated, the nature of driving risk will change, shifting from human error to potential software or hardware failures. This fundamental shift will require insurers to adapt their risk models, coverage offerings, and claims processes. The Treasury report personal auto tech impact analysis suggests that these technological trends are not just incremental changes but represent a significant transformation of the entire auto insurance ecosystem.

The implementation of advanced technology, especially Artificial Intelligence (AI), in underwriting and claims is also transforming operational efficiency for insurers. AI algorithms can analyze vast datasets to identify risk patterns more quickly and potentially more accurately than traditional methods. In claims processing, AI can be used for initial claim assessment, fraud detection, and even estimating repair costs based on photo analysis. While this can streamline processes and potentially lead to faster claim resolutions for consumers, it also raises questions about algorithmic bias and the potential for technology to introduce new forms of inequity if not carefully managed. The human element in complex claims or unique situations remains vital, and ensuring that technology supplements, rather than replaces, necessary human judgment and empathy is an ongoing challenge.

Consumers need to be aware that technology is not just a tool for efficiency for insurers; it directly impacts their experience and costs. Opting into usage-based programs, understanding data privacy policies, and recognizing how technology might influence future coverage needs are all part of navigating the modern auto insurance market. The Treasury report emphasizes that stakeholders, including regulators, insurers, and consumer groups, must collaboratively address the challenges and opportunities presented by technological change to ensure the market remains fair, competitive, and serves the needs of all drivers.

Implications of Artificial Intelligence in Auto Insurance

Building upon the broader theme of technological change, the Treasury report specifically calls out the role of Artificial Intelligence (AI) as a major force shaping the future of the personal auto insurance business. AI’s potential applications in the industry are vast, ranging from refining risk assessment and pricing to automating customer service interactions and streamlining claims management. Understanding the implications of AI is crucial for grasping the full scope of the Treasury report personal auto tech impact.

AI algorithms can process and analyze massive amounts of data far more quickly and efficiently than humans. In underwriting, this means insurers can potentially incorporate a wider array of data points into their risk calculations, theoretically leading to more precise pricing. For instance, AI could analyze driving data from telematics devices, publicly available traffic data, and even information about road conditions in specific areas to create highly customized risk profiles for individual drivers. The goal is to align premiums more closely with the true risk presented by each policyholder, moving towards a more granular and potentially fairer system based on individual driving behavior.

However, the deployment of AI in insurance is not without its challenges and concerns. As the Treasury report notes, while AI may align premiums more closely with relevant driving behavior, it may also raise consumer concerns about security, privacy, and transparency.

- Security: AI systems rely on large datasets, often containing sensitive personal and driving information. Ensuring the robust cybersecurity of these systems is paramount to prevent data breaches and protect consumer privacy.

- Privacy: The extensive data collection required for some AI applications, such as usage-based insurance utilizing telematics, raises questions about how much personal information insurers should collect and how it should be used and stored. Consumers need assurances that their data is being handled responsibly and ethically.

- Transparency: AI models, particularly complex deep learning systems, can sometimes be difficult to interpret, leading to a black box problem. It can be challenging for insurers, regulators, and consumers to fully understand why a particular premium was set or a claim decision was made if it’s based on a complex AI algorithm. This lack of transparency can make it difficult for consumers to understand how to potentially lower their costs or dispute decisions they believe are unfair.

- Data Integrity and Bias: The accuracy and fairness of AI-driven decisions depend heavily on the quality and nature of the data used to train the algorithms. If the training data contains biases (for example, reflecting historical discriminatory practices or skewed demographic representation), the AI system can perpetuate and even amplify those biases, leading to potentially unfair outcomes for certain groups of consumers. Ensuring data integrity and actively working to identify and mitigate bias in AI models is a critical task for the industry and regulators.

The report highlights that state insurance regulators and other stakeholders are currently evaluating these public policy implications as use cases for AI continue to develop. The potential benefits of AI in terms of efficiency and personalized pricing are significant, but they must be balanced against the potential risks to consumer protection, privacy, and equity. Regulators are tasked with ensuring that the adoption of AI technology in insurance benefits consumers and the market as a whole, without creating new avenues for unfair discrimination or exploiting consumer data.

The ongoing dialogue between insurers, technology developers, regulators, and consumer groups is essential to navigate the ethical and practical challenges posed by AI in insurance. As AI becomes more integrated into the core functions of auto insurance, from initial quotes to final claims payouts, its impact on the consumer experience and the fairness of the market will only grow. The Treasury report serves as a timely reminder that proactive monitoring and thoughtful regulation are necessary to harness the potential benefits of AI while mitigating its potential downsides.

Treasury Recommendations for Insurers and Regulators

Based on its analysis of the personal auto insurance market, including the cost trends, underwriting practices, and the impact of technology, the Treasury report put forth several key recommendations for both state insurance regulators and the insurance industry. These recommendations are designed to address the challenges identified and guide the market towards greater fairness, transparency, and efficiency for consumers. Understanding these recommendations is key to grasping the forward-looking aspect of the Treasury report personal auto tech impact analysis.

The report emphasizes the need for continued vigilance and proactivity from regulatory bodies. Here are the core recommendations:

- State insurance regulators should continue to monitor and analyze the cost and availability of personal auto insurance for consumers. This recommendation underscores the importance of ongoing oversight. Regulators need to keep a close watch on premium trends, the factors driving those changes, and whether insurance remains accessible and affordable for all drivers, including those in underserved communities or with challenging risk profiles. Continuous data collection and analysis are essential for identifying potential problems early.

- Insurers and regulators should build on existing efforts to reduce the frequency and severity of auto accidents to lower auto insurance costs. While insurance covers the financial aftermath of accidents, reducing the number and impact of accidents is the most effective way to lower overall claims costs, which can, in turn, help stabilize or reduce premiums. This involves collaborative efforts on road safety initiatives, promoting safe driving habits, and potentially incentivizing vehicles with advanced safety features. Insurers can play a role through risk management programs and public education campaigns.

- Legislators, regulators and the National Association of Insurance Commissioners (NAIC) should continue to monitor insurers’ use of proxy factors. This recommendation directly addresses the concerns raised about fairness and potential discrimination in pricing based on characteristics like credit score, age, and education level. It calls for ongoing scrutiny of how these factors are used and their impact on different consumer groups.

- The NAIC and its Center for Insurance Policy and Research should study and report on the use of proxy factors. Complementing the previous point, this recommendation urges the NAIC, a key organization for state insurance regulators, to undertake formal studies on the effects of proxy factors. Research can provide valuable data and insights to inform regulatory decisions and potentially lead to national standards or guidelines regarding the acceptable use of rating factors.

- State insurance regulators and the NAIC should continue to focus on auto insurers’ use of artificial intelligence and the effects of its increased use on consumers, cybersecurity, data privacy, and data integrity. This highlights the proactive approach needed regarding AI. As AI adoption accelerates, regulators must understand its implications for consumers, particularly concerning potential biases in algorithms, the security and privacy of the vast amounts of data collected, and ensuring the accuracy and reliability (data integrity) of the data and the AI’s outputs.

- The NAIC should update its 2022 Private Passenger Artificial Intelligence/Machine Learning surveys every two years. To effectively monitor the evolving use of AI, regulators need current information. Regular surveys of insurers regarding their adoption and use of AI/Machine Learning technologies will provide essential data for analysis and regulatory response. The biennial frequency suggests a commitment to keeping pace with rapid technological advancements.

These recommendations collectively paint a picture of a regulatory environment striving to balance innovation with consumer protection. They acknowledge the potential benefits of technology and data-driven approaches while also emphasizing the need for fairness, transparency, and accountability. For consumers, these recommendations suggest that there is ongoing attention from government bodies regarding the fairness and affordability of their auto insurance.

Ultimately, the goal is to ensure that the personal auto insurance market operates efficiently, provides necessary financial protection to drivers, and does so in a manner that is equitable and understandable. The successful implementation of these recommendations will require cooperation between regulatory bodies at the state level, the NAIC, and the insurance industry itself. As technology continues to evolve, this ongoing dialogue and adaptation will be crucial for the future of auto insurance. Keeping informed about these regulatory discussions and industry changes is part of being a well-prepared policyholder in the modern age.

The Federal Insurance Office (FIO), established by the Dodd-Frank Act, plays a vital role in monitoring the insurance industry and issuing reports like this one to inform policy and promote market stability and consumer protection. Their work helps provide valuable insights into complex financial sectors like insurance.

Understanding the nuances of auto insurance coverage is also essential for consumers, regardless of market trends or technological shifts. Coverages like bodily injury liability, property damage liability, collision, comprehensive, and medical payments each serve a distinct purpose in protecting you financially after an accident. Knowing 5 important auto coverages to consider can help you build a policy that meets your specific needs and state requirements, providing peace of mind on the road. The factors discussed in the Treasury report influence the cost of these vital protections.

Staying informed about reports like the one from the Treasury and understanding the key factors influencing the market, including the significant Treasury report personal auto tech impact, empowers you as a consumer. It allows you to engage more effectively with your insurance provider and make the best choices for your personal situation.

The auto insurance landscape is dynamic, shaped by economic forces, regulatory oversight, and accelerating technological advancements. The Treasury’s report provides a timely snapshot of these influences, highlighting both the challenges and the opportunities present in the market today. For individuals navigating their personal auto insurance needs, being aware of these broader trends is incredibly beneficial.

As technology continues to advance, we can anticipate even more changes in how auto insurance is priced, sold, and managed. Usage-based insurance programs will likely become more common, leveraging data from connected cars and telematics devices to offer highly personalized pricing. This shift could reward safer driving habits with lower premiums, but it also necessitates clear guidelines around data privacy and security to maintain consumer trust. The ethical considerations surrounding AI and algorithmic bias in underwriting will remain a key area of focus for regulators and the industry. Ensuring that AI systems do not inadvertently discriminate against certain groups is paramount for maintaining a fair market.

Beyond pricing and underwriting, technology is also transforming the claims process. AI-powered tools are being used for everything from initial claim reporting and fraud detection to estimating repair costs and even facilitating virtual inspections. While this can lead to faster and more efficient claims handling, consumers need to be confident that technology is being used to enhance the process, not to unfairly deny or undervalue claims. Transparency in how technology influences claims decisions is just as important as transparency in underwriting.

The recommendations put forth by the Treasury emphasize a proactive and collaborative approach. Regulators are encouraged to continue monitoring market trends and the effects of technology, while also working with insurers to promote initiatives that could lead to lower costs, such as accident prevention efforts. The call for the NAIC to study and report on proxy factors and regularly survey the use of AI demonstrates a commitment to evidence-based policymaking and staying current with industry practices. These actions are vital for ensuring the auto insurance market remains stable and serves the public interest.

For consumers, the key takeaway from the Treasury report personal auto tech impact analysis is that staying informed is more important than ever. Understanding how factors like your driving habits (increasingly tracked by technology) and potentially even non-driving factors like credit history influence your rates is crucial. Being aware of the types of coverage available and selecting adequate protection beyond the minimum state requirements is also a cornerstone of sound financial planning. For instance, knowing does auto insurance cover medical expenses through coverages like PIP or MedPay can prevent significant out-of-pocket costs after an accident.

The future of personal auto insurance will undoubtedly be shaped by technology. As AI and other advancements become more deeply integrated into the industry’s operations, the benefits of efficiency and personalized pricing must be carefully weighed against potential risks to consumer privacy, data security, and fairness. The Treasury report provides a critical framework for understanding these complex interactions and outlines a path forward for regulators and the industry to address them collaboratively, ultimately aiming for a more stable, equitable, and consumer-friendly auto insurance market. Consumers should view this report as a valuable resource that highlights the importance of staying engaged with their insurance options and understanding the forces that influence their costs and coverage.

Have questions? Contact us here.